Grow your savings with WhānauSaver.

Set yourself up for retirement, first home ownership or tertiary education. As well as receiving annual contributions from your Iwi, your money is invested with SuperLife giving you the choice of 6 funds that could help grow your savings even faster.

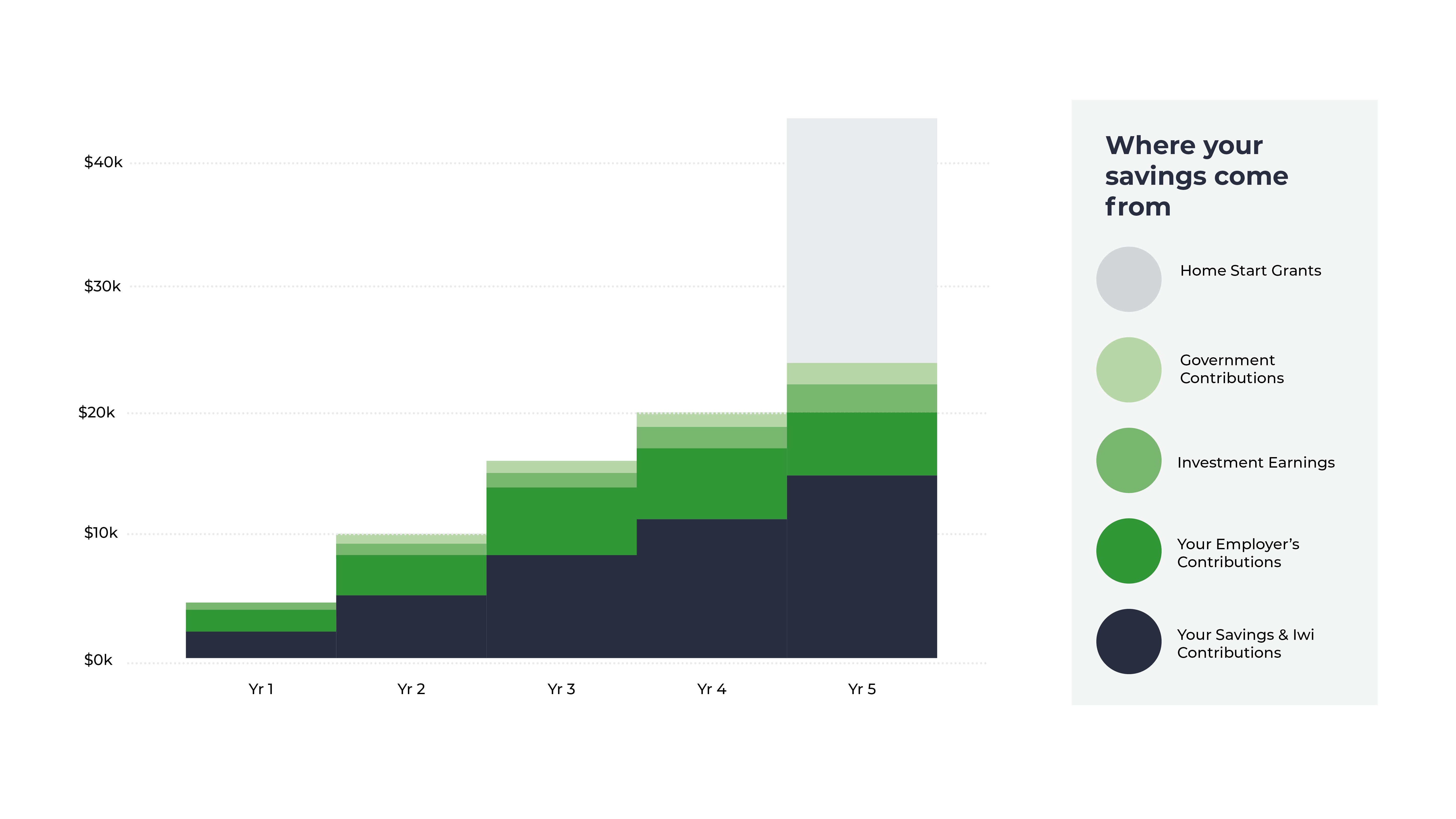

Using WhānauSaver alongside KiwiSaver is a fantastic way to maximise your savings towards a deposit on your first home.

In the example below, Tāne and Aroha are both working and earn a combined income of $75,000 per year. In only five years they are able to build up to $45,000 towards their first home deposit.

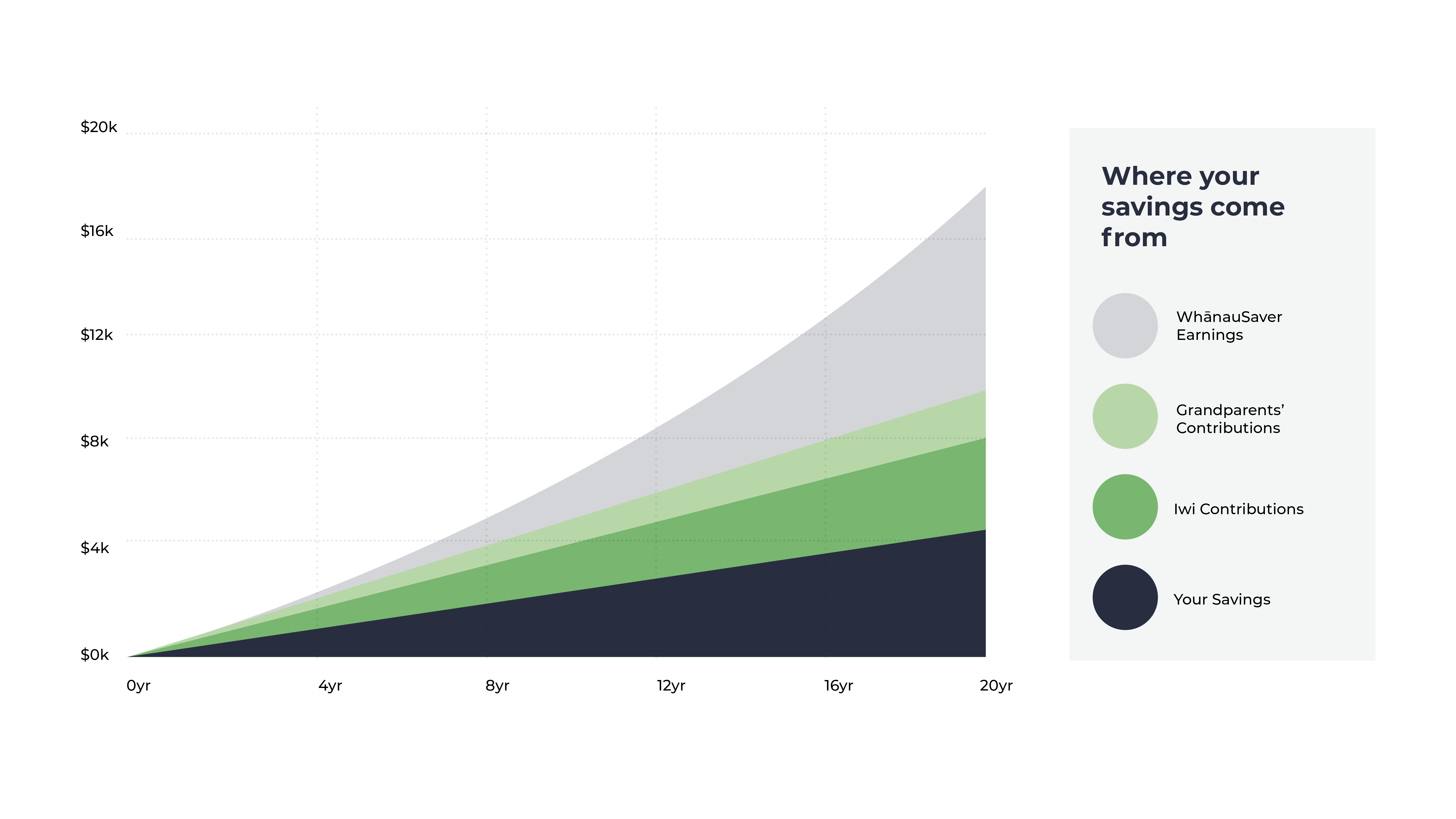

WhānauSaver is a great way to save for the future of your tamariki. By saving into a WhānauSaver account, your tamariki can also receive Iwi contributions and WhānauSaver earnings, maximising your saving efforts.

WhānauSaver accounts can be set up from birth, and your wider whānau can also contribute.

If you start early, it only takes small regular deposits to grow a meaningful nest egg for the future of your tamariki. They can use their WhānauSaver earnings towards their Tertiary Education or as a deposit on their first home.

In the example below Wiremu’s whānau set up a WhānauSaver account when he was a newborn.

With WhānauSaver, you can withdraw your funds from age 55. That’s ten years earlier than you can access your KiwiSaver funds.

Similarly to KiwiSaver, you can also withdraw your funds in cases of death, serious illness or significant financial hardship.

WhānauSaver is a powerful way to invest in your financial future and the future of your tamariki. Accounts can be set up from birth and can be contributed to by your wider whānau, including grandparents and your iwi – which over time can grow to create a financial nest egg for retirement, education, housing or financial emergencies.

WhānauSaver was designed by Te Kotahitanga o Te Atiawa and Te Kāhui o Taranaki in conjunction with SuperLife

For more information on WhanauSaver read the product disclosure statement.

WhānauSaver is intended to complement your KiwiSaver account.

For more information on WhanauSaver read the product disclosure statement.

For more information on WhanauSaver read the product disclosure statement.

You must be a registered member of one or more of the eligible participating Iwi.

If you are a member of more than one of the eligible Iwi, you could receive multiple contributions to your WhānauSaver – there’s never been a better time to ensure you’re registered with all the iwi that you whakapapa to.

Iwi partnerships in WhānauSaver is growing so check back regularly if you don’t see your iwi listed below.

For more than 20 years SuperLife has been caring for and nurturing the financial wellbeing of New Zealanders. The programme is delivered by Smartshares through SuperLife, using its registered SuperLife Invest and SuperLife KiwiSaver schemes.

SuperLife believes that a passive approach to investing will deliver better long-term results. Passive investing means SuperLife will either invest in a fund designed to track an index or in a number of assets for the long term. SuperLife do not think that constantly changing investments (that is, trading regularly and seeking short-term gains), consistently adds value to investors.

Smartshares Limited is the manager of the SuperLife Managed Investment Schemes. The product disclosure statements are available at www.superlife.co.nz

To add another iwi to your WhānauSaver account you’ll need to email whanausaver@kauruora.nz and request to add an iwi. We will need to confirm that you are a registered member of the Iwi.

This can be fast tracked if you provide a confirmation letter from your chosen iwi and/or an email from the Iwi registration officer confirming you are indeed a registered member.

For more than 20 years SuperLife has been caring for and nurturing the financial wellbeing of New Zealanders. The programme is delivered by Smartshares through SuperLife, using its registered SuperLife Invest and SuperLife KiwiSaver schemes. Smartshares is a proud partner of Ka Uruora as the provider of WhanauSaver, a savings programme with special features and benefits to help whanau achieve their financial goals.

Smartshares Limited is the manager of the SuperLife Invest and SuperLife KiwiSaver Schemes. The product disclosure statement is available at www.superlife.co.nz